“Retirement isn’t a number in a bank account. It’s the ability to live comfortably without ever needing to trade your time for a paycheck again.”

The $3,000 “Ghost Salary”

Last year, my CPF retirement fund quietly generated $35,684.14 in total interest. For an ordinary person on the street, this is a life-changing “ghost salary” of nearly $3,000 every single month—fully guaranteed, risk-free, and tax-free. It is a salary that requires no boss, no 80-minute commute, and no 5:37 AM alarm.

For 32 years, I navigated the daily grind of a normal working-class career. I didn’t have a ‘high-flyer’ salary. But by sticking to the ‘Safe and Save’ way of life and maximizing my Retirement Account (RA) to the 2026 ERS of $440,800, I built an engine that most people assume requires a massive salary. I’m writing this to prove that you don’t need to be a tycoon to retire well in Singapore—you just need a plan.

1. The ‘Green Page’ Reality: My Freedom Foundation

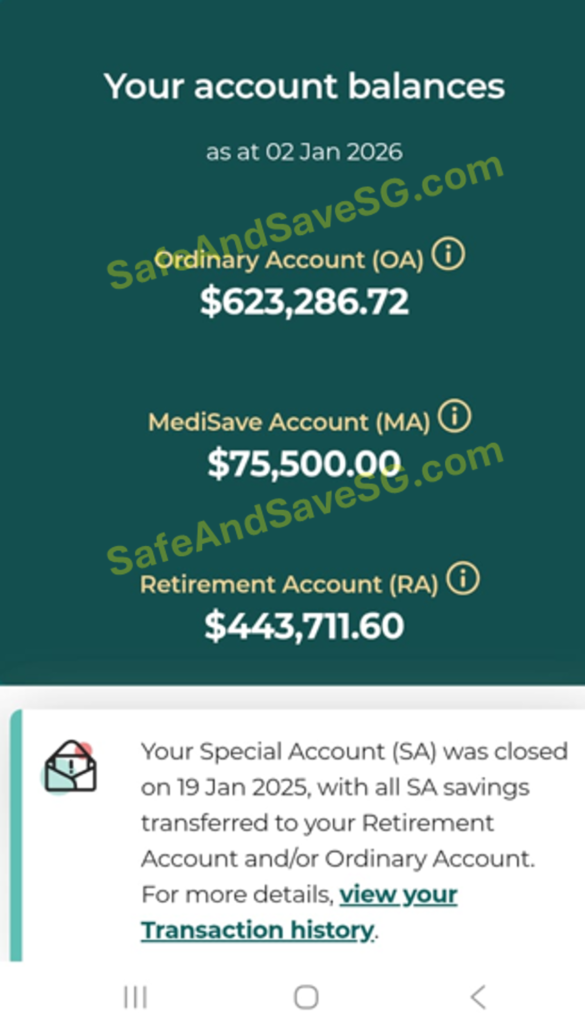

Before we discuss the “how,” we must look at the “what.” In the financial world, transparency is rare. This is my “Green Page”—the total summary of my CPF balances as of early 2026. This isn’t just a list of numbers; it’s the result of three decades of ignoring the “noise” and focusing on the “save.”

My “Safe & Save” Portfolio (Jan 2026)

Total liquidity and payout protection working in harmony.

Combined Balance: Over $1,100,000

2. The Myth of the ‘Property Windfall’

In Singapore, the standard story of wealth usually involves property. We hear about the “flippers”—people who bought a resale flat in a prime area, sold it for a $400,000 profit, and saw their CPF accounts balloon overnight. While that is a valid way to build wealth, it relies heavily on timing and luck.

I did not flip property. My journey was far less “exciting.” I lived in the same home, focused on clearing my mortgage, and let the 4% and 2.5% interest rates do the heavy lifting. Why is this important for you? Because it means you don’t need to be a property genius to retire a millionaire. You just need to understand the “Safe and Save” engine. If you didn’t win the “BTO lottery,” don’t worry—the interest engine is open to every Singaporean who has the discipline to fuel it.

3. Breaking Down the $35,684.14 Interest Engine

Let’s look at the “Ghost Salary” in detail. This interest is not just one number; it is a symphony of three different accounts working together. When you reach a certain threshold, the interest stops being “pocket money” and starts being a “life-support system.”

2026 Interest Credit Summary

Total Interest: $35,684.14

2026 CPF Interest Credit Summary

This $35k breakdown represents three specific strategic victories:

- The RA Victory: Reaching the ERS allowed my Retirement Account to generate over $17,000 in interest alone. This is my “pension” before CPF LIFE even starts.

- The MA Victory: Capping the Medisave at $75,500 meant that every dollar of interest ($2,995) now covers my insurance premiums, making my healthcare essentially free for life.

- The OA Victory: By clearing my housing debt and making voluntary refunds, my Ordinary Account interest topped $14,000. That is cash I can use for my retirement years or leave as a legacy.

4. The Psychological Fortress: Why I Chose Safety Over Growth

Critics often tell me: “Peter, if you put that $1M in the S&P 500, you’d have $2M!” They might be right on paper, but they are wrong on human psychology.

In your 50s and 60s, the most valuable asset you can own is not “growth”—it is Certainty. The stock market is a rollercoaster. I have seen friends lose sleep, hair, and health when the markets drop 20% in a month. When you have a “Safe and Save” foundation, you have a psychological fortress. Whether the US election goes left or right, whether the tech bubble bursts or booms, my $35,000 interest is coming. This certainty allows me to enjoy my kopi at the hawker center without checking a stock app. It allows me to spend time with my family without the “background noise” of financial anxiety.

5. The Ordinary Professional’s Roadmap

If you are earning a comfortable income today—whether it’s $5,000 or $8,000—the path is the same. You don’t need a “windfall.” You need to manage your “leakages.” Every time you buy a car you don’t need, or a watch that costs two months’ salary, you are delaying your “Ghost Salary” by years.

I chose to live modestly. I chose the “Safe” path because I realized that in Singapore, the system is designed to reward the patient. If you feed the system, the system will eventually feed you.

Conclusion: The View from the Finish Line

Reaching a $1.1M CPF balance and a $35k annual interest payout is not a sprint; it is a 32-year marathon. But I can tell you, the view from the finish line is beautiful. It is the view of a man who is truly free—free from debt, free from medical worries, and free from the stress of the markets. Start your “Safe and Save” journey today. It doesn’t matter how fast you go, as long as you don’t stop.

This journey started with reaching my $623k OA Milestone.

Find out the overview of Interest on your CPF savings