Disclaimer: I am sharing my personal CPF journey and actual snapshots from 2025/2026 to illustrate the “Safe and Save” philosophy. I am not a financial advisor. I am an ordinary worker sharing 32 years of discipline.

Introduction: The ‘Bucket’ That Protects Your Family

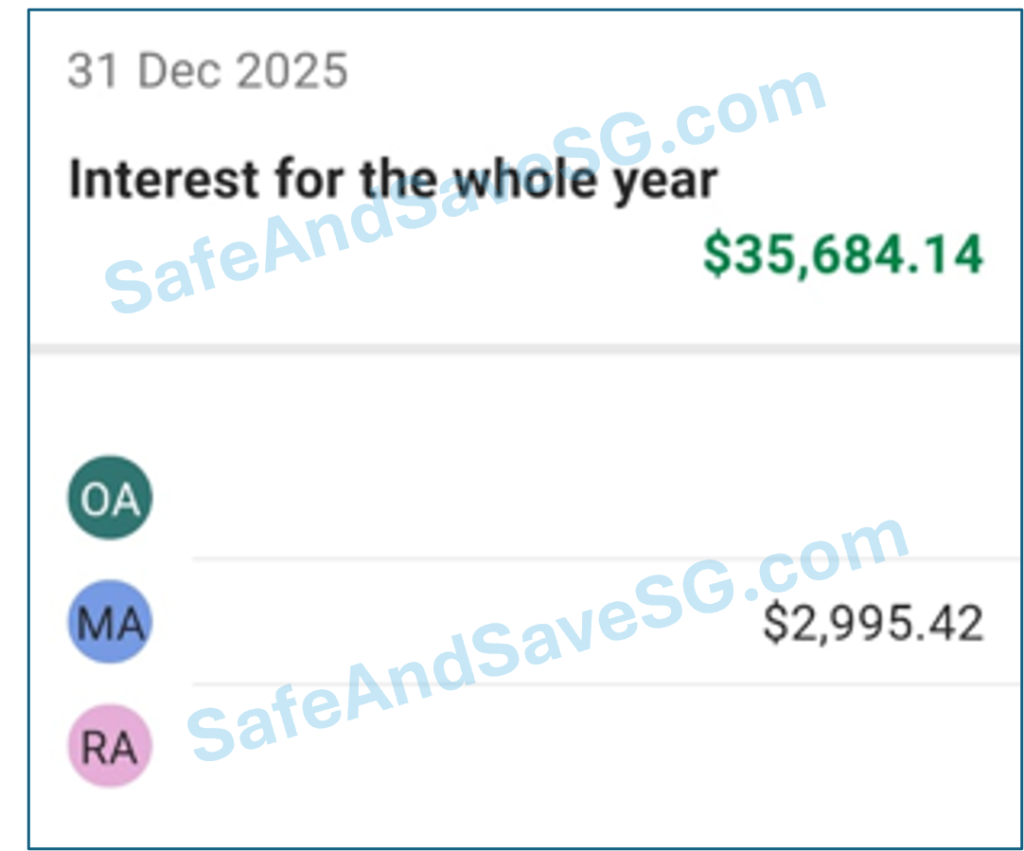

Most Singaporeans look at their Medisave Account (MA) as a “medical tax”—money locked away for a rainy day in the hospital. For 32 years, I felt the same way as I endured the 80-minute commute and that 5:37 AM alarm. But I’ve realized that the MA is actually the most strategic “bucket” in the entire CPF system. Last year, my MA earned nearly $3,000 in risk-free interest. But the real story is the Peace of Mind that comes when the bucket finally overflows.

I don’t share this to boast, but to show why prioritizing your healthcare fund can eventually become a “wealth generator” for your retirement. Once your health is secured, the system starts feeding your wealth.

1. The Power of the $75,500 Milestone

In 2025/2026, the Basic Healthcare Sum (BHS) is the maximum amount an individual keeps in their Medisave. For many, $75,500 sounds like a mountain too high to climb. I felt the same as an ordinary worker. But by consistently “filling the bucket,” I finally reached that peak.

2. The ‘Overflow’: When Health Funds Fuel Retirement

Once your Medisave hits the BHS cap, a beautiful thing happens: The Overflow. Since the “bucket” is full, any new contributions—and even the annual interest—will “overflow” into your Retirement Account (RA).

In 2025, my MA interest was $2,995.42. Because I was at the cap, this interest didn’t stay in Medisave. It flowed into my RA, helping me reach my $440,800 ERS goal even faster. This is how the system rewards the disciplined worker.

3. Cultivating the Habit: The Uncle Peter Way

I was an ordinary worker for decades; I didn’t get here overnight. Here is the habit I used to fill the bucket:

- The “Bonus” Rule: I treated my MA like a priority. Every rebate or bonus was a chance to “top up.”

- The “Tax” Trick: Topping up Medisave is the best way to “pay yourself” instead of the taxman.

- Protect the 4%: I often choose to pay small medical bills with cash to let my Medisave continue to earn its 4% compounded.

This is also why I stay active. I run 4km every day because the best way to protect your Medisave is to not need it!

4. Psychological Freedom: “Don’t Worry About Me”

The greatest benefit of a full Medisave account isn’t the interest—it’s the Freedom from Fear. By securing the BHS, I can tell my family: “Don’t worry about my medical costs. I have taken care of it.” That sense of responsibility is what drove me through those 32 years of work.

Conclusion: Fill the Bucket, Secure the Future

The journey to the BHS is a marathon, not a sprint. By reaching this cap, I turned a necessity into a retirement engine. Start filling that bucket today—the overflow is where your true financial freedom begins.

Final Piece of the Puzzle:

See how this Medisave overflow helps fuel my $3,000 Monthly “Ghost Salary” in my Retirement Account.