Disclaimer: I am sharing my actual 2026 CPF statement to provide a transparent case study on the power of the Retirement Account (RA). This is not financial advice, but a record of a 32-year journey in building a “Safe and Save” retirement.

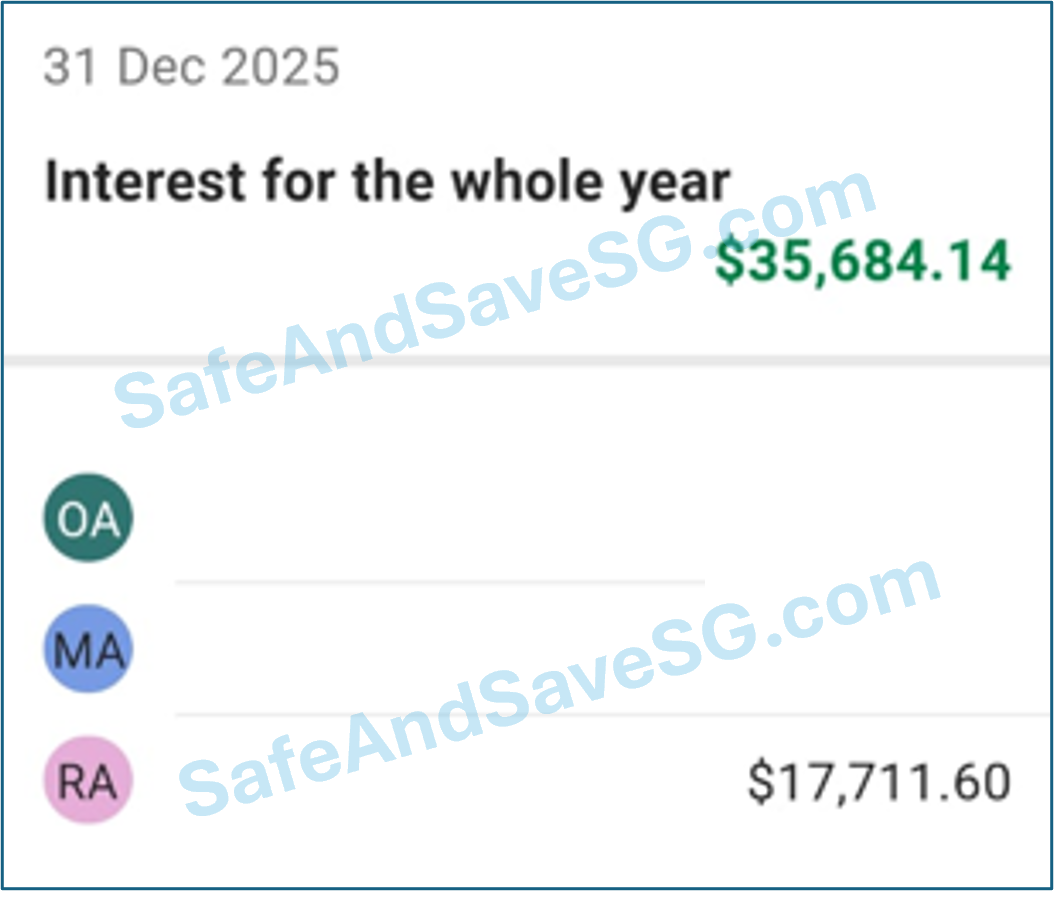

The $17,711 RA Interest: Building a ‘Perpetual Motion Machine’ for Retirement

“I used to throw my statements away. But when I saw $17,711.60 in annual interest, I realized my money was working harder than I was. This is the reward for the ‘Slave Worker’ who stays disciplined.”

1. The Logic of the Snowball: From $426k to $443k

In the world of engineering, we look for efficiency. In the world of finance, the CPF Retirement Account (RA) is the most efficient engine I have ever found. As you can see in my 2026 snapshot, my balance grew from $426,000 to over $443,000. This didn’t happen because I was “smart”—it happened because the engine was running.

2. The 4% Floor: The Ultimate ‘Sleep-at-Night’ Factor

Usually, if you want a 4% return, you have to take risks. The stock market can crash. However, the CPF RA 4% interest is floor-protected by the Singapore Government. This certainty allows me to plan my life with confidence. I am not “gambling” on my future; I am “securing” it.

In January 2026, the government credited $17,711.60 in interest to my account. That is money earned while I was eating, sleeping, and exercising.

Like a snowball, the $17,711 interest rolls back into the principal to earn even more next year.

3. The Psychological Barrier: “It’s My Money, But I Can’t Touch It”

The most common complaint I hear is that CPF money is “stuck.” This is a psychological trap. By “locking” the money at 4%, the system protects us from our own spending impulses. I chose to be kind to my future self by leaving the money to earn interest. It is about trading a small amount of “Liquidity” today for a massive amount of “Security” tomorrow.

4. Tactical Tips for Every Singaporean

- Maximize your Medisave (MA) first: Once your MA hits the Basic Healthcare Sum (BHS), contributions “overflow” into your Special or Retirement Account. This is a “free” way to speed up your RA growth!

- Don’t fear the age 55 milestone: If you have been disciplined with your OA, you can choose to move more than the Full Retirement Sum (FRS) into your RA to hit the ERS.

- Focus on the Interest: When you start seeing your annual interest hit $17,000, you stop seeing it as “locked money” and start seeing it as a “working employee.”

Conclusion: Your Interest Engine Starts Today

Seeing $17,711.60 credited was a humble moment. It reminded me that the “Habit of Saving” is the most powerful skill any Singaporean can learn. Start your top-ups today. Let the 4% engine start running, so that one day, you too can receive a “salary” while you sleep.

This interest is part of the Habit of Saving I developed early on.

Calculate your CPF Retirement Sums here.