The Price of Chicken Rice: Why I Built an “Inflation Shield”

In 1994, I was just a junior professional starting my 32-year journey in the Singapore workforce. Back then, a plate of chicken rice was $1.50. Today, in 2026, I pay $5.50 at my local hawker centre. Inflation isn’t just a statistic—it is a “silent thief.” As a regular guy, I realized I couldn’t “out-work” this forever. I needed an Inflation Shield.

1. The “Reverse Compounding” of Inflation

We often talk about how interest makes us rich, but inflation works in reverse to erode our savings. I chose the “Safe and Save” path by leveraging the CPF system’s 4% floor rate. This stability allowed me to ignore the market crashes of 2008 and 2022, focusing instead on a guaranteed return that stays ahead of the rising costs of daily life in early 2026.

2. Adapting to the 2026 Realities (SA Closure)

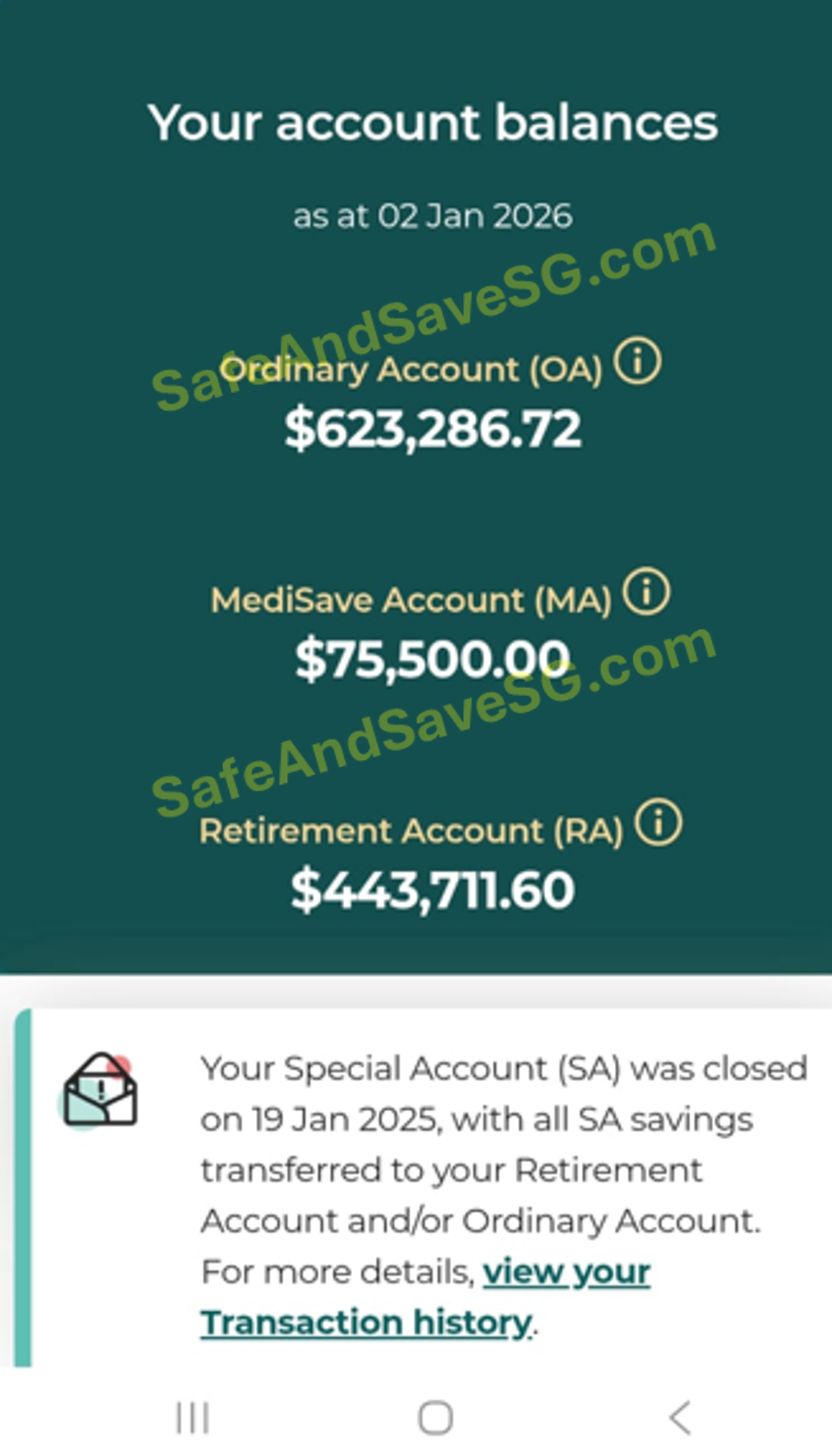

Many were caught off guard by the closure of the Special Account (SA) for those 55 and above. But the “Safe and Save” practitioner adapts. To keep my 4% shield, I maximized my Retirement Account (RA) up to the 2026 Enhanced Retirement Sum (ERS) of $440,800. This move secured the lifelong payouts I need to stay ahead of inflation.

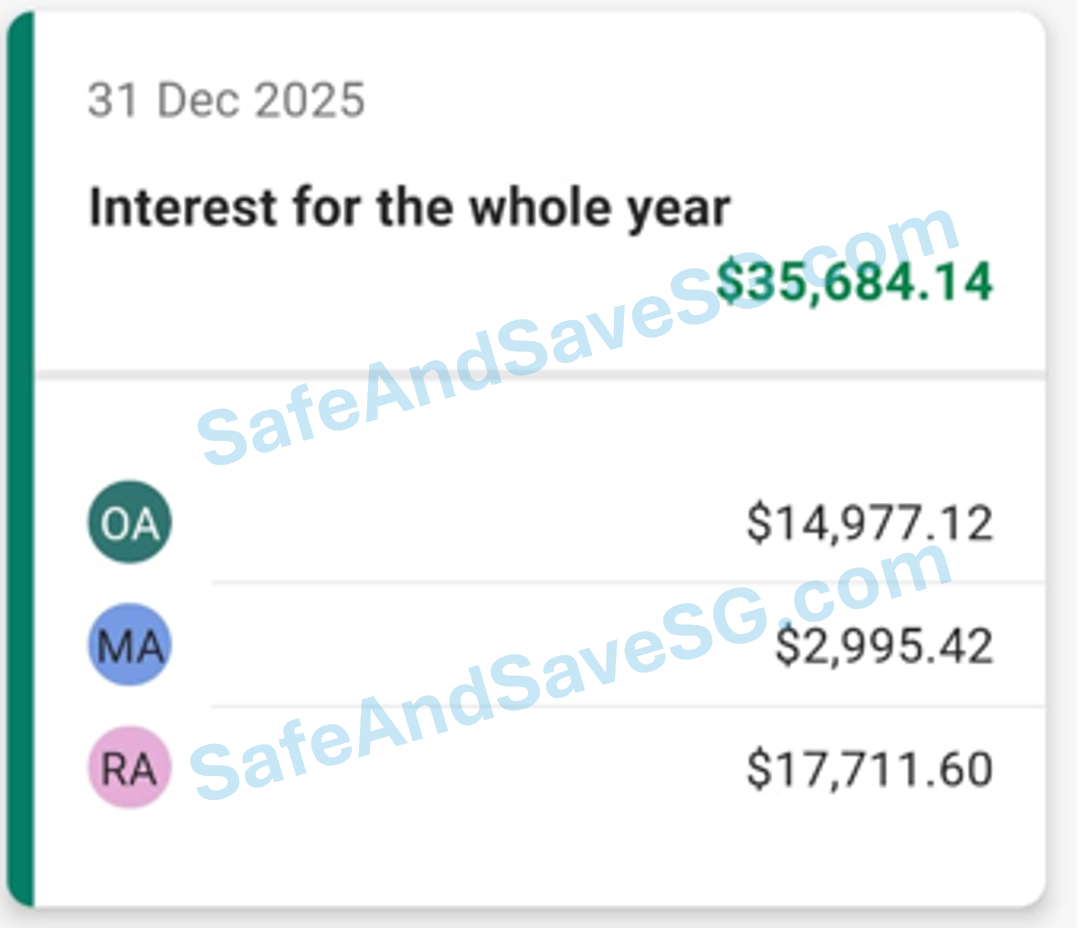

Verified 2026 Interest Statement

My actual interest earned: $35,684.14. This is the shield that protects my lifestyle.

3. The “Medisave Overflow” Turbo Button

The **Basic Healthcare Sum (BHS)**—capped at **$75,500**—is a tool most people ignore. Once my Medisave hit this limit, the interest began to “overflow” into my Retirement Account. This accelerated my progress toward my goals without me having to work any harder. It means my healthcare is funded, and my wealth continues to grow quietly.

4. The Psychology of Being “Boring”

To build a strong foundation on an ordinary salary, you must accept that “Boring is Beautiful.” While others were stressed by crypto volatility or stock crashes, I stayed focused on the 4% guaranteed floor. Over 32 years, that consistency is what created the results you see today. You don’t need to be a genius; you just need to be disciplined.

My “Safe & Save” Foundation (2026)

A foundation built over 32 years as an ordinary worker.

5. Frequently Asked Questions

“Is it too late to start if I’m 45?”

Not at all. The first $100k is the hardest. Once you pass it, the compounding starts doing the heavy lifting. Even 10-15 years of discipline can change your retirement story.

Conclusion: You Don’t Need to be a CEO

You don’t need a tycoon’s salary to beat inflation. You need a plan and the patience to let the math work. Today, I sit at my local kopitiam, enjoying my eggs and toast, knowing that my foundation is working harder than I ever did. I don’t worry about the price of chicken rice because I am safe. It starts with one small step today.