“I don’t have a high salary, so I can’t save that much.” I hear this often at the coffee shop. But after 32 years in the workforce, I realized wealth isn’t about what you earn—it’s about how much you keep from the ‘accrued interest’ trap.

The Rescue Mission: Housing Refunds (Jan 2026)

Many Singaporeans don’t realize that when they use CPF to buy a home, they are essentially taking a loan from their future selves. As of early 2026, I have successfully executed a $187,000 Housing Refund. This wasn’t about paying off a house; it was about stopping the ‘leak’ and moving my money back into the 2.5% and 4.0% interest-bearing sanctuary of my CPF accounts.

1. The HDB Decision: My Greatest Asset

The most important decision I made wasn’t a stock market tip; it was the house I chose. In Singapore, your house is either your greatest asset or your greatest “CPF drain.”

When I was younger, I saw many peers moving into condominiums the moment they got a promotion. They wiped out their OA and used 100% of their monthly contributions for the mortgage. Their OA stayed at $0 for decades. I chose a modest HDB. My mortgage was affordable, so my “surplus” stayed in my account, earning 2.5% interest. Over 30 years, that choice added hundreds of thousands to my nest egg.

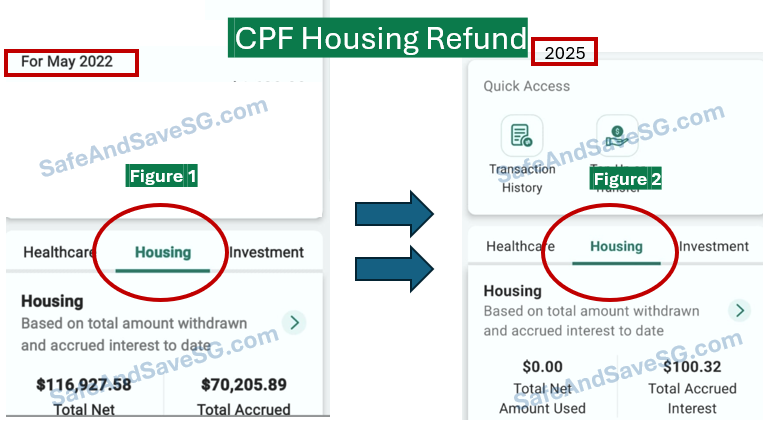

2. Facing the Truth: The $70,000 ‘Hidden’ Debt

One day in 2022, I looked closely at my CPF Mobile app and realized I was living with a “silent debt.” It wasn’t to a bank; it was to my own retirement. My statement showed I had used $116,927 of my OA for my house. But the Accrued Interest—the interest I lost by not keeping that money in CPF—had grown to $70,205.89.

That accrued interest was nearly 60% of my original loan! For an ordinary worker, $187k sounds like an impossible mountain. I felt the same way. I realized there is no regret medicine for the past, but I could stop the leak today.

A Message of Hope: If you are discouraged by your “Net Amount Used” figure, know that I started where you are. This is about the habit and the persistence to stop a leak before it sinks your retirement boat.

3. The “Drip Method”: How I Chipped Away at the Mountain

I did not have a windfall. I used the “Drip Method.” I treated my housing refund like a monthly bill. Most of us find ways to pay for Netflix or dining out; I decided to make “Future Me” a priority bill. I started small—some months $500, some months $5,000 from a bonus. The amount mattered less than the victory of taking back my home from the interest “tax.”

4. The Sacrifices We Don’t Talk About

To clear $187,132 in three years, I had to ignore the “Joneses.” While others posted holiday photos, my family and I stayed humble. We cooked at home and kept our old car. You are trading temporary status for permanent security. My “Zero” balance in 2025 represents a thousand small choices to say “No” today so I could say “Yes” to my freedom.

5. The Mathematical Reward: 2.5% Guaranteed

By doing a housing refund, I was “earning” a 2.5% return because I stopped the interest from compounding against me. In the financial world, a guaranteed 2.5% risk-free return is gold. You aren’t gambling on stocks; you are investing in your own roof.

6. Step-by-Step: Start Today with $50

If you have $50 you don’t need for emergencies, you can start now:

- Step 1: Log in to the CPF Mobile App.

- Step 2: Tap ‘Make a payment’ and select ‘Housing Refund’.

- Step 3: Use PayNow to transfer even just $50.

The moment that $50 hits, your accrued interest stops growing on that amount. The habit is more powerful than the amount.

Conclusion: Give Yourself the Gift of Hope

Clearing $187k wasn’t just about money—it was about freedom. Today, if I sell my house, every cent of the profit comes to me. Wealth is built in the quiet moments of discipline. Don’t look at the mountain. Look at the first step.

Stopping this leak allowed me to reach my $35k Passive Income goal.

Read more on CPF Housing Schemes.